Candlestick patterns are honestly the thing that pulled me out of some of my dumbest trading holes, like, seriously. Sitting here in my cramped apartment in Chicago – it’s December, freezing outside, and I’ve got this space heater humming away while I stare at charts for hours – these little wicks and bodies have taught me more about market psychology than any fancy indicator ever could.

Anyway, I remember back in 2020, during that wild pandemic volatility, I ignored a massive bearish engulfing on Tesla and got absolutely wrecked. Lost like 20% of my account in a week. Embarrassing, right? But that’s when I dove deep into candlestick patterns, and man, it’s been a game-changer ever since. Not perfect – I still screw up plenty – but these top 10 candlestick patterns are the ones I swear by now.

Why Candlestick Patterns Still Matter in My Messy Trading Life

Look, I’m no pro guru. I’m just a regular dude in the US grinding day trades and swings, fueled by too much coffee and regret from past blowups. Candlestick patterns give me that quick gut check on sentiment. They’re not magic – markets fake you out all the time – but when they line up with support/resistance or volume, it’s like the chart’s whispering secrets.

A candid, slightly tilted screenshot from my own TradingView setup showing a mix of these patterns on a real stock chart (like AAPL or something volatile), with my annotations scribbled in – unusual angle focusing on the cursor hovering over a key candle. Descriptive alt text: “My marked-up chart spotting candlestick patterns in real-time – coffee stains on the desk included for authenticity.”

My Top 10 Candlestick Patterns (The Ones That Actually Showed Up When I Needed Them)

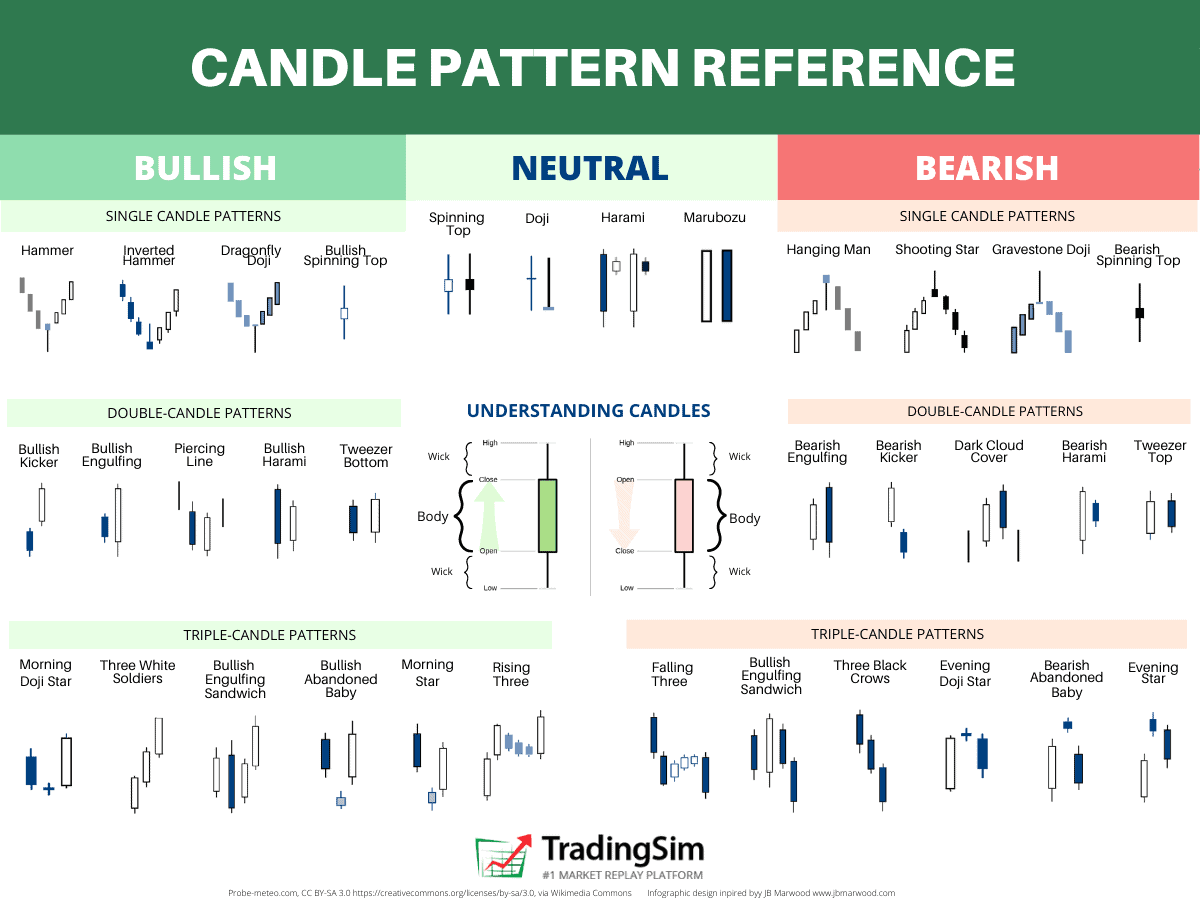

Here’s my personal ranking of candlestick patterns, based on how often they’ve bailed me out or at least warned me. I mix bullish and bearish because, duh, markets go both ways.

The Doji – That Indecision Mess I Love/Hate

Doji candlestick patterns scream “nobody knows what’s going on” to me. Open and close basically the same, long shadows – it’s pure tug-of-war. I spotted one on Bitcoin back in 2022 at a major low, went long, and it flipped the trend. But yeah, I’ve also gotten chopped ignoring context.

From my screen of a classic doji on a daily chart, captured at an odd angle with reflections of my tired eyes – personal vibe. Descriptive alt text: “A real doji candlestick pattern I traded live – indecision turned reversal.”

:max_bytes(150000):strip_icc()/DojiDefinition-efc3ba7213db4200a0a69f354369960b.png)

What Is a Doji Candle Pattern, and What Does It Tell You?

For more on doji, check out Investopedia’s guide.

Hammer – My Go-To Bullish Savior

The hammer candlestick pattern? Long lower wick, tiny body up top – it’s like sellers got exhausted and buyers smashed back. I nailed a few crypto bottoms with these during dips. But confession: I once mistook a weak one for a hammer and got rekt on a fakeout.

Slightly blurry personal capture of a hammer forming on my chart, from over my shoulder view – unusual and immersive. Descriptive alt text: “Hammer candlestick pattern popping up on my watchlist – bullish reversal vibes.”

:max_bytes(150000):strip_icc()/TermDefinitions_Hammercandlestick-2da527c1bdc14ccda68f787243632f59.png)

Hammer Candlestick: What It Is and How Investors Use It

Shooting Star – The Bearish Gut Punch

Opposite of hammer – long upper wick, body down low. Signals buyers tried and failed. Caught a few shorts on overhyped stocks with this.

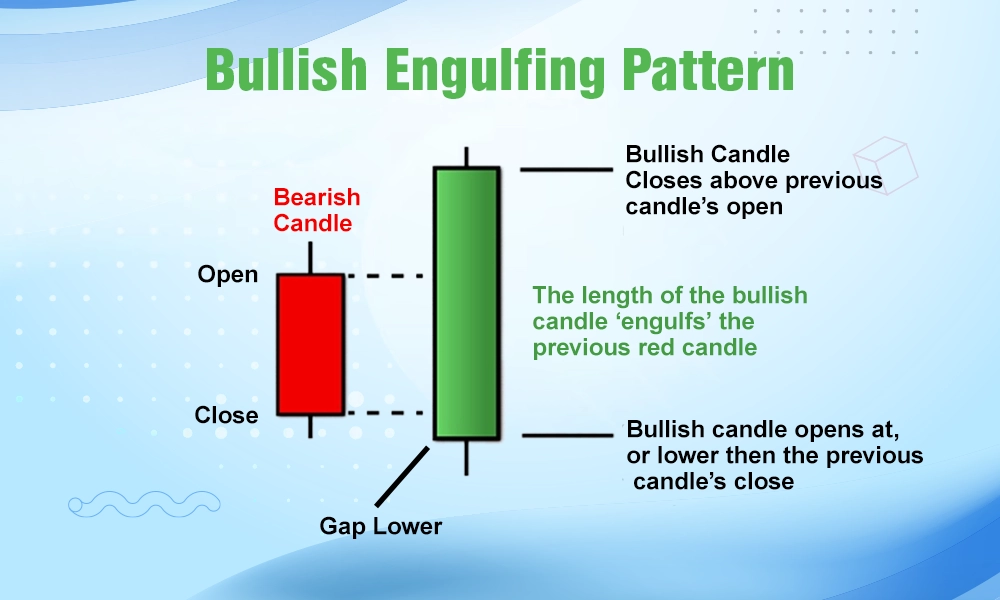

Bullish Engulfing – That Aggressive Takeover Feel

Big green candle swallowing the previous red one. Pure buyer dominance. One of my favorites for entries after pullbacks.

My annotated engulfing pattern on a recent trade, shot from a weird side angle showing my notebook nearby. Descriptive alt text: “Bullish engulfing candlestick pattern in action – swallowed the bearish one whole.”

Engulfing Candlestick Patterns in Trading | Meaning and Types

See strategies on BabyPips.

Bearish Engulfing – Sellers Going Ham

Red candle eating the prior green. I’ve used this to exit longs early more times than I care to admit.

Morning Star – The Hopeful Dawn After a Beatdown

Three-candle beauty: big red, small body gap down, then strong green. Feels like relief after a downtrend slaughter.

Personal view of a morning star on SPY, with my excited highlight marks – quirky angle including my fist pump shadow. Descriptive alt text: “Morning star candlestick pattern bringing bullish hope.”

Morning Star Candlestick: Definition, Structure, Trading, Benefits …

Evening Star – The Party’s Over Signal

Bearish version – green, small, big red. Spotted this on NVDA once and shorted… profited, but held too long and gave some back. Classic me.

Spinning Top – More Indecision Drama

Small body, long shadows both ways. Not as strong as doji, but warns of potential reversals.

Three White Soldiers – Bullish Momentum I Ride

Three strong greens marching up. Love these for continuation in uptrends.

Three Black Crows – The Bearish Plunge

Three reds down – scares me into cash sometimes.

These candlestick patterns aren’t foolproof – I’ve had winners and losers with all – but combining them with stuff like RSI or moving averages? Gold.

Wrapping This Ramble Up – My Flawed Advice on Candlestick Patterns

Whew, that got longer than I planned, like most of my trading sessions. Candlestick patterns have been my crutch through dumb mistakes and lucky streaks here in the States. They’re raw, honest glimpses into crowd panic and greed.

If you’re starting out, paper trade these top candlestick patterns first – don’t be like past me blowing real money on hunches. Anyway, what’s your favorite pattern that’s saved (or doomed) you? Drop a comment, or just go chart something. Trade smart, y’all – or at least smarter than I did last year. Peace.