Bitcoin halving is one of those things that sounds super technical but honestly hits me right in the gut every four years, like clockwork. I’m sitting here in my cramped Brooklyn apartment on December 22, 2025, snow flurrying outside my window, stale coffee going cold next to me, staring at my portfolio eight months after the latest Bitcoin halving—and yeah, it’s complicated.

What the Heck Is Bitcoin Halving, Anyway? (My Dumbed-Down Version)

Look, I’m no Satoshi. The Bitcoin halving is literally just the block reward for miners getting cut in half. Used to be 50 BTC per block, then 25, then 12.5, then 6.25, and after April 2024 it dropped to 3.125 BTC. That’s it. Fewer new Bitcoins flooding the market every ten minutes or so. Supply goes on a diet while demand… well, hopefully stays hungry.

I remember the night of the 2024 Bitcoin halving—I was refreshing block explorers like a total degenerate, eating cold pizza at 3 a.m. because I couldn’t sleep. My girlfriend at the time thought I was insane. She wasn’t wrong.

5+ Thousand Money Flying Out Wallet Royalty-Free Images, Stock …

Why Bitcoin Halving Usually Messes With the Price (And My Emotions)

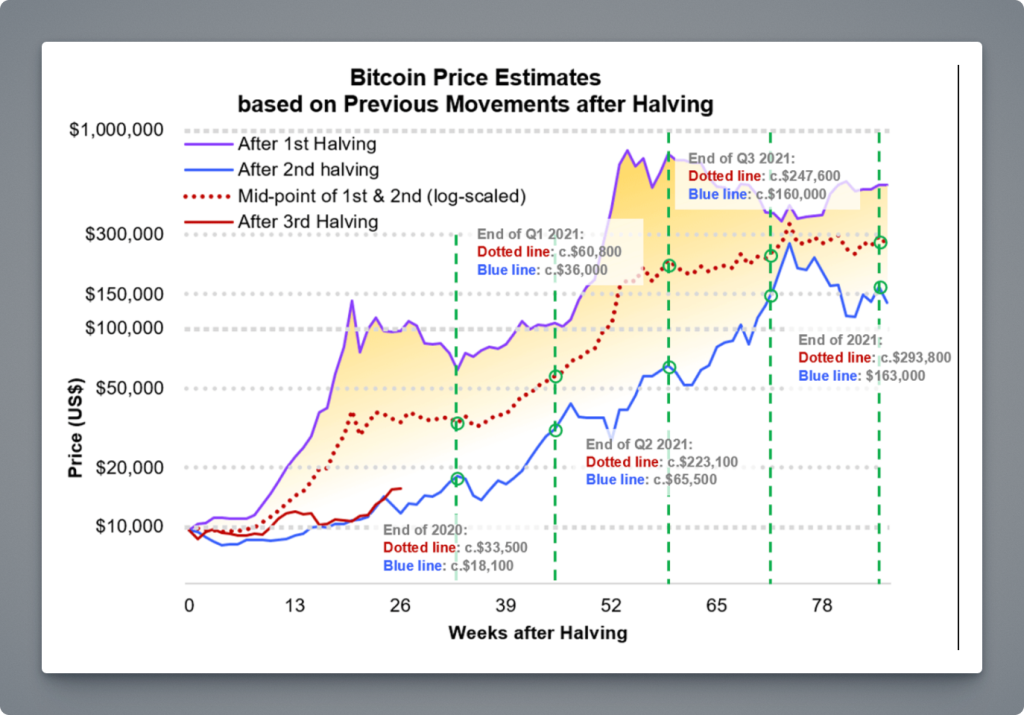

Here’s the theory everyone parrots: less new supply + same or growing demand = price go up. Historically? Yeah, it’s worked. Like, embarrassingly well.

- 2012 halving → price from ~$12 to over $1,000 in a year

- 2016 halving → ~$650 to almost $20k

- 2020 halving → ~$9k to $69k peak

But 2024–2025? We hit about $73k right before the halving, dipped hard to the low 50s over summer (I was sweating bullets, seriously), and now we’re grinding back toward six figures. My wallet feels like it’s on a rollercoaster designed by a sadist.

I’ll be honest—I panic-sold a chunk at $56k this past summer because rent was due and I got scared. Biggest regret of my crypto life so far. Still kicking myself.

How Bitcoin Halving Actually Hits Miners (And Why I Care)

Miners are the ones who really get punched in the face first. Their rewards literally get halved overnight. A bunch of smaller operations shut down after the last Bitcoin halving—hash rate dropped like 10-15% initially. The big industrial miners in Texas and Kazakhstan? They just scooped up the slack.

I follow a couple miners on X and the vibe was grim for months. One guy I know in upstate New York sold his rigs on eBay just to pay electric bills. Meanwhile, BlackRock’s ETF is slurping up Bitcoin like it’s free. Feels unfair sometimes, ya know?

So… What Did Bitcoin Halving Do to My Wallet This Time?

Mixed bag, if I’m keeping it 100 with you.

The good: My long-term stack I swore I’d never touch is up roughly 80% from pre-halving levels. Feels nice when I check it once a month and don’t cry.

The bad: I traded way too much around the event, got rekt on leverage twice (don’t ask), and paid more in taxes than I care to admit because I’m an idiot who didn’t journal properly.

The ugly: I still have nightmares about missing the real pump. Everyone’s saying “supercycle this, spot ETFs that,” but I’ve been burned enough times to stay half-cash on the sidelines. Contradictory? Absolutely. Welcome to my brain.

What Makes Crypto Go Up and Down? (2025 Crypto Price Guide)

My Extremely Flawed Tips If You’re Wondering About the Next Bitcoin Halving

We’re roughly halfway to the 2028 one now, so here’s what I wish someone told me:

- Don’t try to time the exact bottom or top. I’ve failed spectacularly every time.

- Dollar-cost average through the halving year if you can. Boring wins.

- Keep some dry powder—volatility is brutal post-halving (check historical charts on CoinMarketCap).

- Learn basic on-chain stuff. I started watching glassnode metrics after getting wrecked and it’s helped me chill out a bit (Glassnode is worth the subscription if you’re serious).

- And for the love of god, use a hardware wallet. I almost lost everything in 2022 to a phishing site because I was lazy.

Anyway, that’s my messy, caffeine-fueled take on Bitcoin halving from a very average, very American crypto holder freezing his butt off in New York right now. It’s not financial advice—obviously—just one dude’s rollercoaster.

If you’re new to this and want to dip a toe without getting wrecked, maybe start small on a legit exchange like Coinbase or Kraken, set up recurring buys, and just… hold on tight. The ride’s wild, but looking back, I don’t regret jumping in.

What’s your halving story? Drop it in the comments—I read ‘em all, even the ones calling me an idiot (fair).

Stay warm out there. ✌️