Oil stocks are heating up right now, seriously, and I’m sitting here in my chilly living room in the Midwest, cranking the heat because this December cold snap hit harder than expected, wondering if I should’ve thrown more money into energy plays earlier this year.

Like, I remember back in the summer when oil prices were dipping low – WTI hovering around $60 or whatever – and I was kicking myself for not buying more shares of some big oil names. I had this dumb moment where I sold a chunk of my Exxon position too early, thinking the whole sector was doomed with all the EV hype and oversupply talk. Boy, was that a mistake. Anyway, fast forward to now, and oil stocks heating up feels like a weird redemption arc for me.

Why Oil Stocks Are Heating Up: The Big Drivers I’m Seeing

Look, I’m no expert – just a regular guy in the US who’s been dabbling in stocks for years, making plenty of boneheaded moves along the way. But from what I’m piecing together, oil stocks heating up comes down to a mix of stuff that’s got me both pumped and paranoid.

First off, this winter weather? Brutal. We’re talking colder-than-average temps across the US, Europe, even parts of Asia. That means more heating oil demand, more diesel for everything. I felt it personally – my heating bill spiked last month, and I’m like, dang, if everyone’s cranking the thermostat like me, no wonder oil demand’s getting a boost. Reports from the IEA and EIA point to this cold snap pushing up consumption when everyone thought inventories would just keep building.

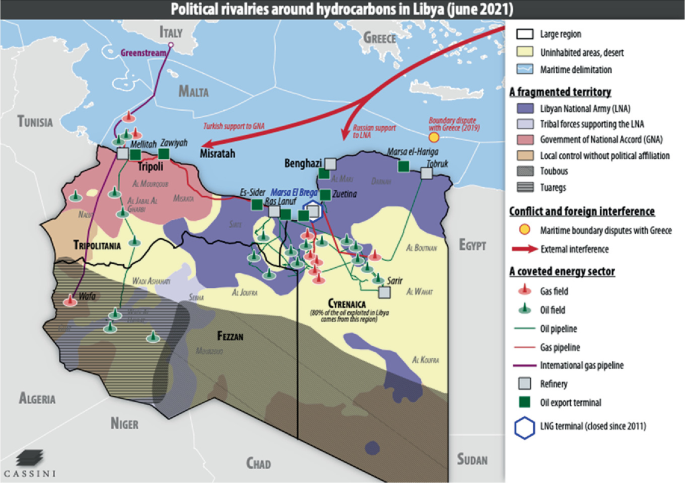

Then there’s the geopolitics, man. Tensions in the Middle East, sanctions tightening on Russia and Iran, shadow fleet issues – it’s all adding this layer of risk premium. Oil stocks are heating up partly because investors like me are betting on potential supply disruptions. I get contradictory feelings about it; on one hand, higher prices sound great for my portfolio, on the other, it’s scary thinking about real-world fallout.

Geopolitics of Oil and Gas in the MENA Region | SpringerLink

And don’t sleep on OPEC+. They’ve been holding back production more than some expected, even with all the surplus chatter. That constrained supply vibe is helping oil stocks heat up, especially for big integrated companies.

Oil Pumpjack Silhouetted Against Sunset with Rising Stock Graph …

My Personal Screw-Ups and Lessons with Oil Stocks Heating Up

Okay, raw honesty time: I once went all-in on a small oil explorer back in 2022, thinking prices would stay sky-high forever. Lost a chunk when things crashed. Embarrassing, right? But it taught me to stick more with the majors – Exxon, Chevron, those guys – when oil stocks are heating up like now.

Lately, I’ve added to my positions in energy ETFs because, let’s face it, picking individual oil stocks heating up can be a gamble. My tip? Don’t go overboard. I learned the hard way that even when things look bullish, surprises happen – like sudden inventory builds or demand dips.

- Watch winter demand closely – cold snaps can supercharge oil stocks heating up short-term.

- Keep an eye on geopolitics (check sources like Reuters or Bloomberg for updates).

- Diversify – mix big oil with some services companies for when the rally really kicks in.

Rising Oil Prices Concept Red Growth Stock Illustration 2642216549 …

The Risks I’m Losing Sleep Over as Oil Stocks Heat Up

I’m optimistic, but contradictory as hell. What if the surplus everyone’s talking about finally tanks prices? EIA’s forecasting inventories rising into 2026, and if demand doesn’t keep pace… yeah, oil stocks heating up could cool off fast. Plus, longer-term, renewables and EVs – I’m driving a hybrid myself now, feeling guilty about my oil holdings sometimes.

Stock market today: Dow futures surge after U.S.-China tariff …

Wrapping This Chat Up: My Take on Oil Stocks Heating Up

Anyway, that’s my messy, unfiltered thoughts from here in the US on why oil stocks are heating up. It’s exciting, but I’m approaching it cautiously – added a bit to my positions, but not betting the farm. If you’re thinking about jumping in, do your own homework, maybe check out the latest from the IEA Oil Market Report or EIA Short-Term Energy Outlook.

What about you? Got any oil plays you’re eyeing? Drop a comment if you’re reading this – let’s chat like real people. Stay warm out there!