Best ETFs to buy in 2025 for long-term growth – man, that’s basically been my obsession lately, sitting here in my cluttered living room in suburban Chicago, coffee going cold next to me while I stare at my laptop screen, the winter light fading outside. Seriously, like, I remember back in 2020 when I panic-sold everything during that crash – total rookie move, lost sleep for months, felt like an idiot watching the rebound from the sidelines. Anyway, now I’m all about these steady, growth-oriented ETFs that I can just buy and forget about, y’know? The ones focused on long-term growth without me having to babysit individual stocks every day.

I’ve been tweaking my portfolio again this week, and honestly, some of these best ETFs to buy in 2025 for long-term growth have me feeling cautiously pumped. Not gonna lie, the market’s been wild this year, but these picks are the ones I’m sticking with because they’ve got that mix of tech innovation and broad exposure that screams potential over the next decade.

Why I’m Obsessed with Long-Term Growth ETFs in 2025

Look, I’m no financial guru – I’m just a regular guy in the US who’s learned the hard way that chasing hot stocks leads to heartburn. Like, last year I threw some money into a meme stock because everyone on Reddit was hyping it… yeah, that ended predictably badly. Embarrassing, right? Now, for long-term growth ETFs in 2025, I’m all in on funds that bet on solid companies poised to compound over years. These best ETFs to buy in 2025 for long-term growth aren’t about quick flips; they’re about sleeping better at night while your money (hopefully) works harder than you do.

Rates might drop more, AI’s still exploding, and honestly, from my view here in the States, the economy feels resilient despite all the noise. But hey, I could be wrong – I’ve been wrong before.

My Top Picks for Best ETFs to Buy in 2025 for Long-Term Growth

Here’s the thing: I narrowed it down to these based on low fees, strong track records, and heavy tilts toward growth sectors like tech and innovation. I cross-checked a bunch of sources like Morningstar and Forbes to make sure I’m not just winging it.

Vanguard Growth ETF (VUG) – My Go-To for Pure Growth Exposure ETF vs Mutual Funds

VUG is basically my largest holding right now. It’s packed with mega-cap growth beasts like Apple, Microsoft, and Nvidia – the stuff driving AI and everything digital. Expense ratio’s tiny at 0.04%, and it’s crushed the market long-term. I started buying more in 2023 after kicking myself for missing earlier gains. For anyone hunting best ETFs to buy in 2025 for long-term growth, this one’s non-negotiable in my book.

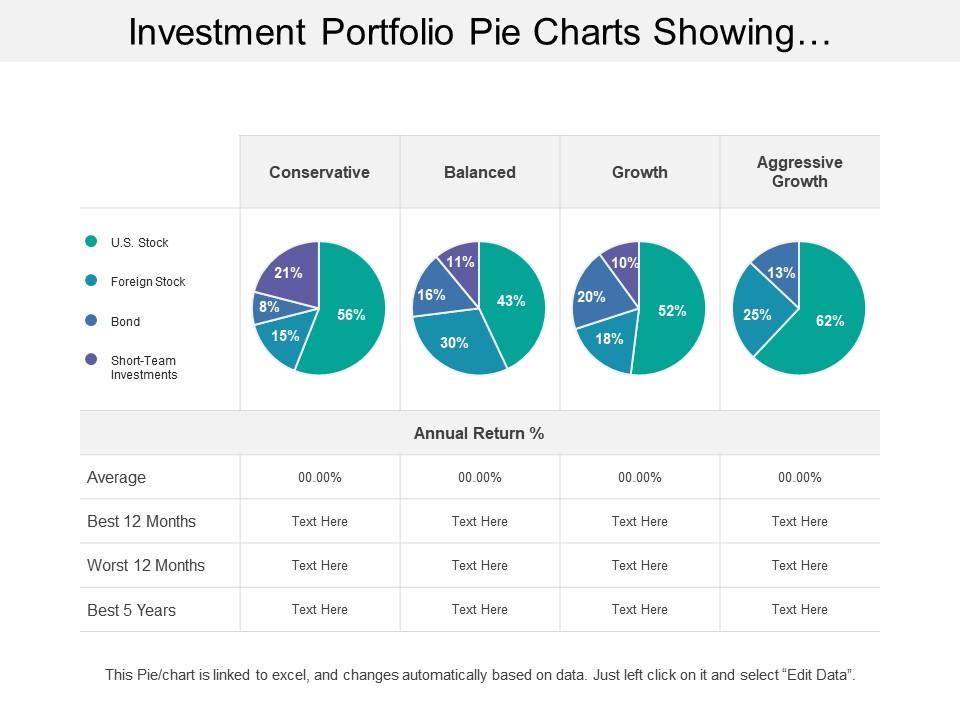

[Insert placeholder: Portfolio pie chart image] Image Details: A slightly off-kilter pie chart from my own brokerage screenshot perspective, showing tech-heavy slices dominating with growth labels, a bit cluttered like my actual app view on a rainy afternoon – descriptive alt text: “My diversified but tech-tilted portfolio pie chart heavy on growth sectors.”

Invesco QQQ Trust (QQQ) or QQQM – The Tech-Heavy Beast ETF vs Mutual Funds

Okay, QQQ (or the cheaper QQQM version) tracks the Nasdaq-100, so it’s all innovative disruptors. Returns have been insane historically, and with AI still in early days, I think it’s primed for more. I own QQQM because lower fees for long-term holds. Back in 2021, I sold some too early chasing “diversification” – dumb move. Lesson learned. This is solidly one of the best ETFs to buy in 2025 for long-term growth if you’re okay with volatility.

Schwab U.S. Large-Cap Growth ETF (SCHG) – The Low-Cost Alternative ETF vs Mutual Funds

Super similar to VUG but even cheaper sometimes in trading. Tracks large growth stocks with big tech weighting. I added this for overlap redundancy – yeah, I double up on growth because, well, that’s where I see the future. Honest contradiction: I preach diversification but lean heavy here. Sue me.

Bonus Mentions for Diversifying Your Long-Term Growth ETFs ETF vs Mutual Funds

- Vanguard Total Stock Market ETF (VTI): For broader exposure if pure growth feels too spicy.

- iShares Core S&P Small-Cap ETF (IJR): Small caps could pop if rates fall more – I’m dipping toes here after ignoring them for years.

These aren’t guarantees – markets crash, life happens. But based on historical data and current trends (check out analyses on Morningstar or Forbes), they’re solid bets.

[Insert placeholder: Personal investing moment image] Image Details: A candid, slightly blurry shot from my perspective of me on the couch scrolling stock apps on my phone, coffee mug nearby, American living room vibes with a window showing snowy suburbs – descriptive alt text: “Me checking my growth ETF holdings on a lazy weekend, real-life investing chaos.”

Wrapping This Up – My Flawed Take on Long-Term Growth in 2025

Whew, that turned into a ramble, didn’t it? Anyway, these best ETFs to buy in 2025 for long-term growth are what I’m riding through whatever 2026 throws at us. Start small if you’re new, dollar-cost average like I do now (after learning not to lump-sum at peaks), and don’t check daily – it’ll drive you nuts.

If you’re on the fence, just pick one or two and commit. What’s your favorite growth ETF right now? Drop a comment – I’d love to hear if I’m missing something obvious. Stay invested, friends.