I’m just a regular guy in the US, mid-30s, juggling a day job and this side hustle obsession with trading. My setup right now? It’s December 2025, snowing outside my window, I’ve got holiday lights blinking annoyingly in the background, and a half-drunk energy drink because I stayed up too late “practicing” again. These apps let me screw up spectacularly without risking my rent money. But they’re not all perfect—some feel too gamified, others overwhelm you with pro tools. Here’s my messy, honest rundown on the best paper trading apps I’ve actually used a ton.

Why I Swear By Paper Trading Apps for Practice Without Risk

Look, paper trading for practice without risk isn’t glamorous. It’s like dating sims before real relationships—kinda cringy, but you learn what not to do. I remember my first virtual blowup on one of these: I “YOLO’d” everything into options, watched my fake portfolio tank 80% in a day, and laughed maniacally because hey, it wasn’t real. But that taught me more than any book. Contradiction time: I love how realistic some are, but hate how they sometimes make you overconfident—like, no app captures the gut-wrench feeling of actual money evaporating. Still, for beginners like past-me, or even now when testing wild ideas, the best paper trading apps are essential.

:max_bytes(150000):strip_icc()/INV_TopStocksJuly2023_GettyImages-1265501626-152d1083c0f34d7db88b068051d965de.jpg)

My Top Picks for the Best Paper Trading Apps in 2025

I’ve tried a bunch, funded fake accounts, reset them when I inevitably imploded. Here’s what stuck for practice without risk.

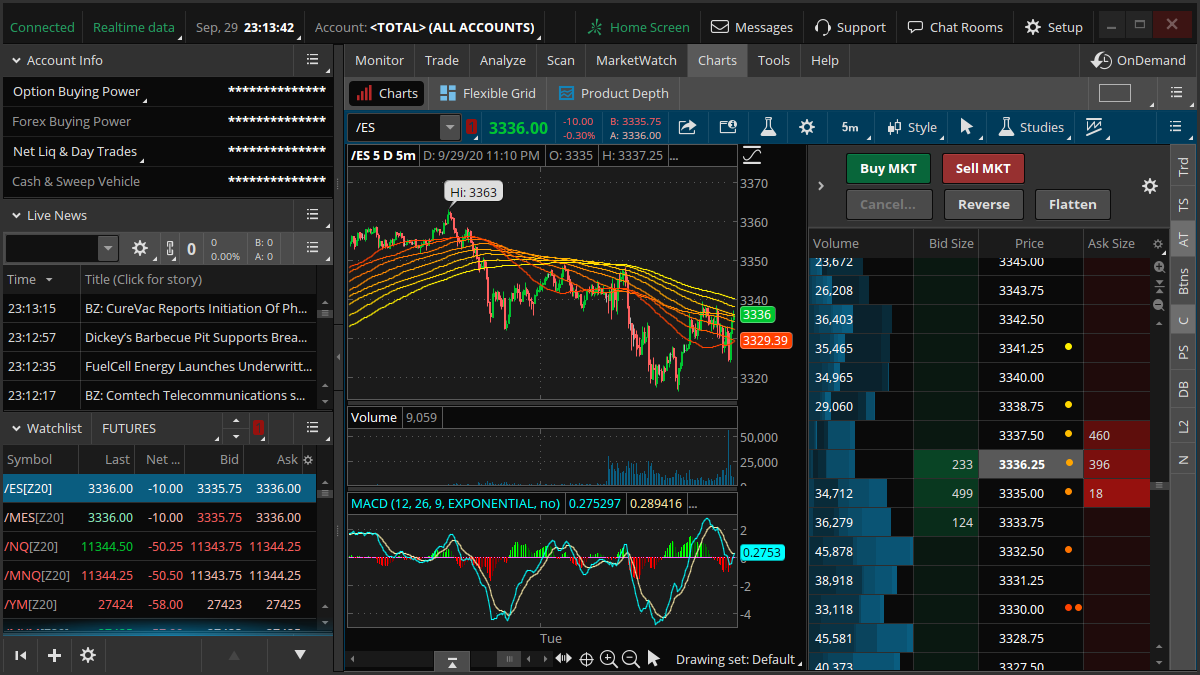

Thinkorswim: The Overkill Beast I Love-Hate

Thinkorswim (now under Charles Schwab) is hands-down one of the best paper trading platforms for serious practice. Their paperMoney mode gives you $100k virtual bucks, real-time data, and tools that feel pro-level. I use it on mobile mostly—swiping through charts while pretending I’m on a train commute here in the Midwest.

But honestly? It’s intimidating at first. My embarrassing story: Spent hours customizing layouts, got lost in options chains, “traded” futures virtually and panicked over margin calls that weren’t real. Sensory overload—charts everywhere, alerts pinging. Yet, that’s why it’s great for risk-free learning. Pros: Insane depth, CNBC integration, 24/7 support even for paper traders. Cons: Steep curve, not super mobile-friendly for quick sessions.

Check it out here: Charles Schwab thinkorswim.

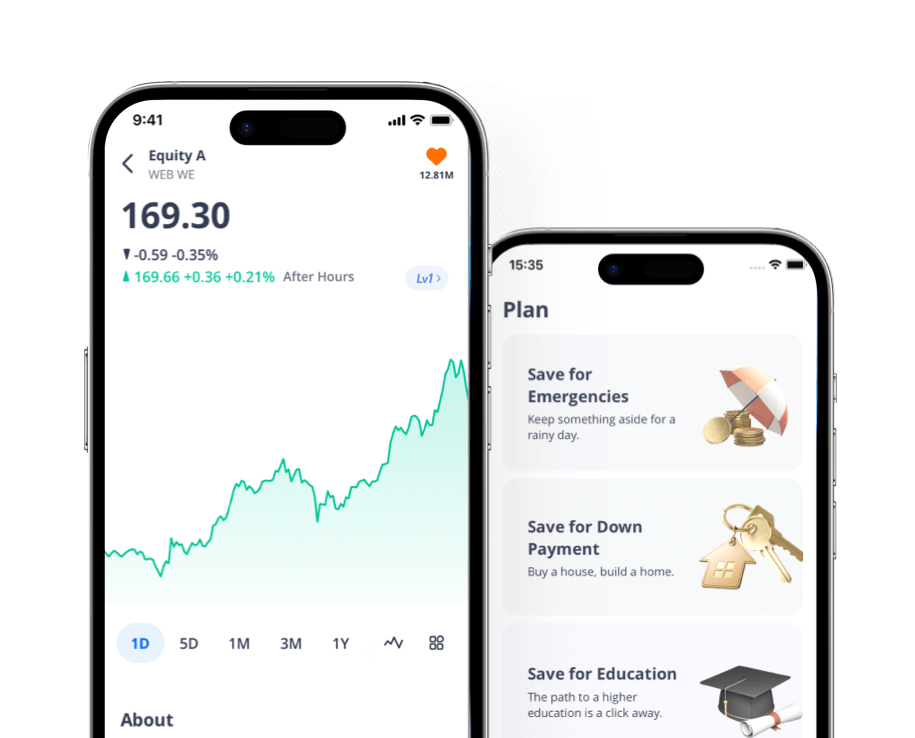

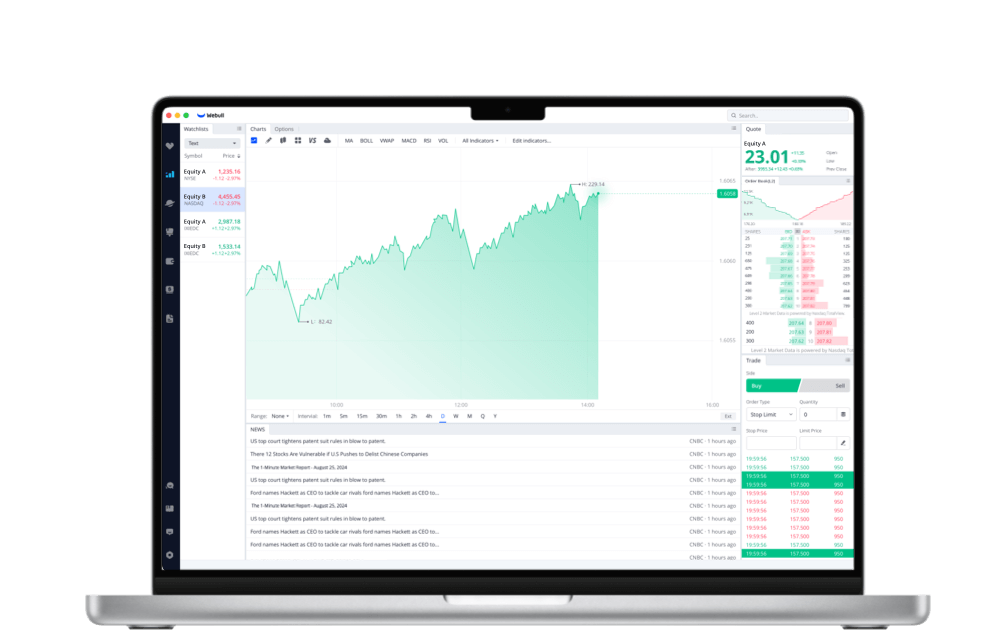

Webull: My Go-To for Quick, Clean Paper Trading Sessions

Webull is probably my most-used for paper trading apps for practice without risk. Unlimited virtual money, super slick mobile app, extended hours—even in simulation. I love firing it up on my phone during lunch breaks, messing with crypto or options virtually.

Personal flop: Once “invested” heavily in a hyped stock, watched it moon then crash, felt zero pain but learned volume tricks. It’s beginner-friendly but powerful. Pros: Free real-time quotes sometimes, community vibes, easy switch to live. Cons: Ads if you’re cheap like me, options paper trading has quirks.

Link: Webull Paper Trading.

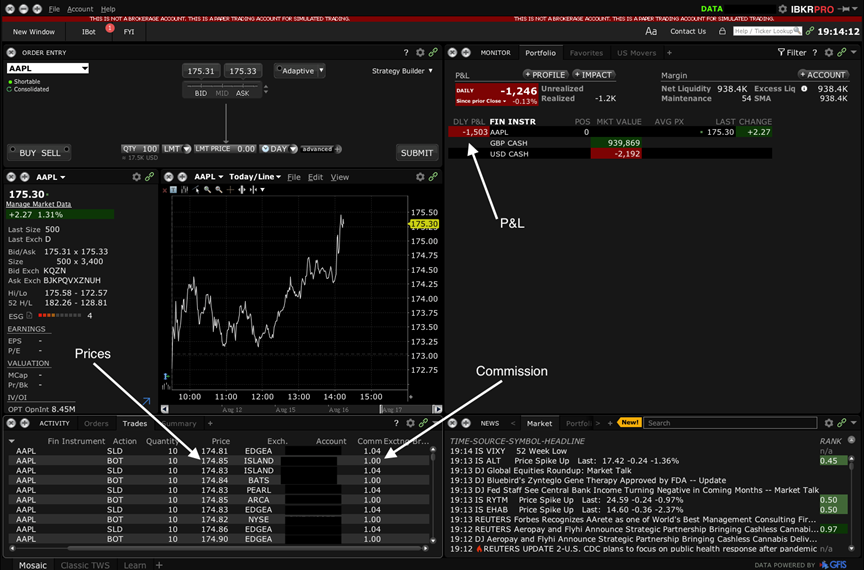

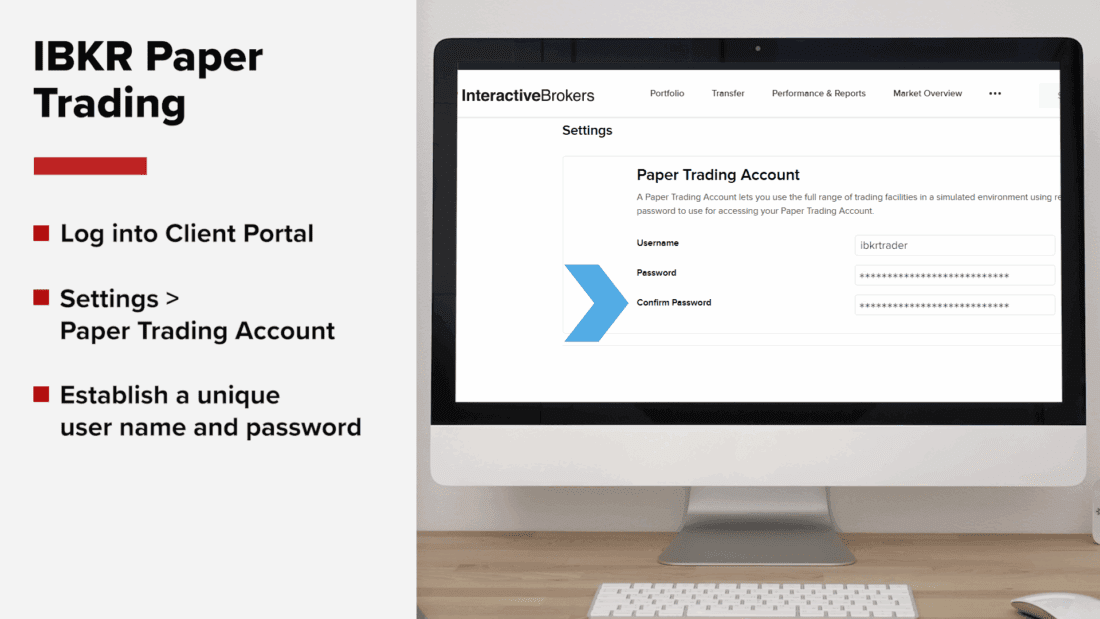

Interactive Brokers (IBKR): For When You Want Ultra-Real Practice Without Risk

IBKR’s paper trading is no joke—mirrors their pro platform exactly, global markets, everything. Great if you’re eyeing international stuff.

But man, the complexity hit me hard. First time: Tried advanced orders, fat-fingered a virtual trade, “lost” big on forex. Felt stupid, but educational. Pros: Most realistic fills, tons of assets. Cons: Overwhelming for casuals, mobile app clunky.

More info: Interactive Brokers Paper Trading.

Other mentions: eToro for social/copy vibes (fun but less “pure” trading), TradingView for charting-integrated paper mode (free, but basic).

Tips From My Flawed Paper Trading Journey

- Start small: Don’t YOLO virtual money—treat it real.

- Journal mistakes: I screenshot my dumb trades, cringe later.

- Mix apps: Use Webull for mobile fun, thinkorswim for deep dives.

- Transition slow: When ready, fund small real amounts.

Anyway, wrapping this up like our chat—best paper trading apps for practice without risk are whatever fits your chaos. Mine’s a mix, because I’m inconsistent like that. Pick one, start messing around today, no excuses. You’ll thank your future self when real money’s on the line. Hit me in comments if you try these!