The 50/30/20 rule literally pulled me out of the hole I was digging last year, and I’m still kinda shocked it worked for someone as disorganized as me. Like, seriously—I’m sitting here in my tiny apartment in Austin on December 22, 2025, with the heater cranking because Texas decided to fake winter today, and my bank account isn’t screaming at me for once. That’s wild. I used to just… spend money until it was gone, then panic-eat Whataburger at 2 a.m. while refreshing Venmo to see who owed me twenty bucks.

Why I Finally Tried the 50/30/20 Rule (And Didn’t Hate It) streams of income

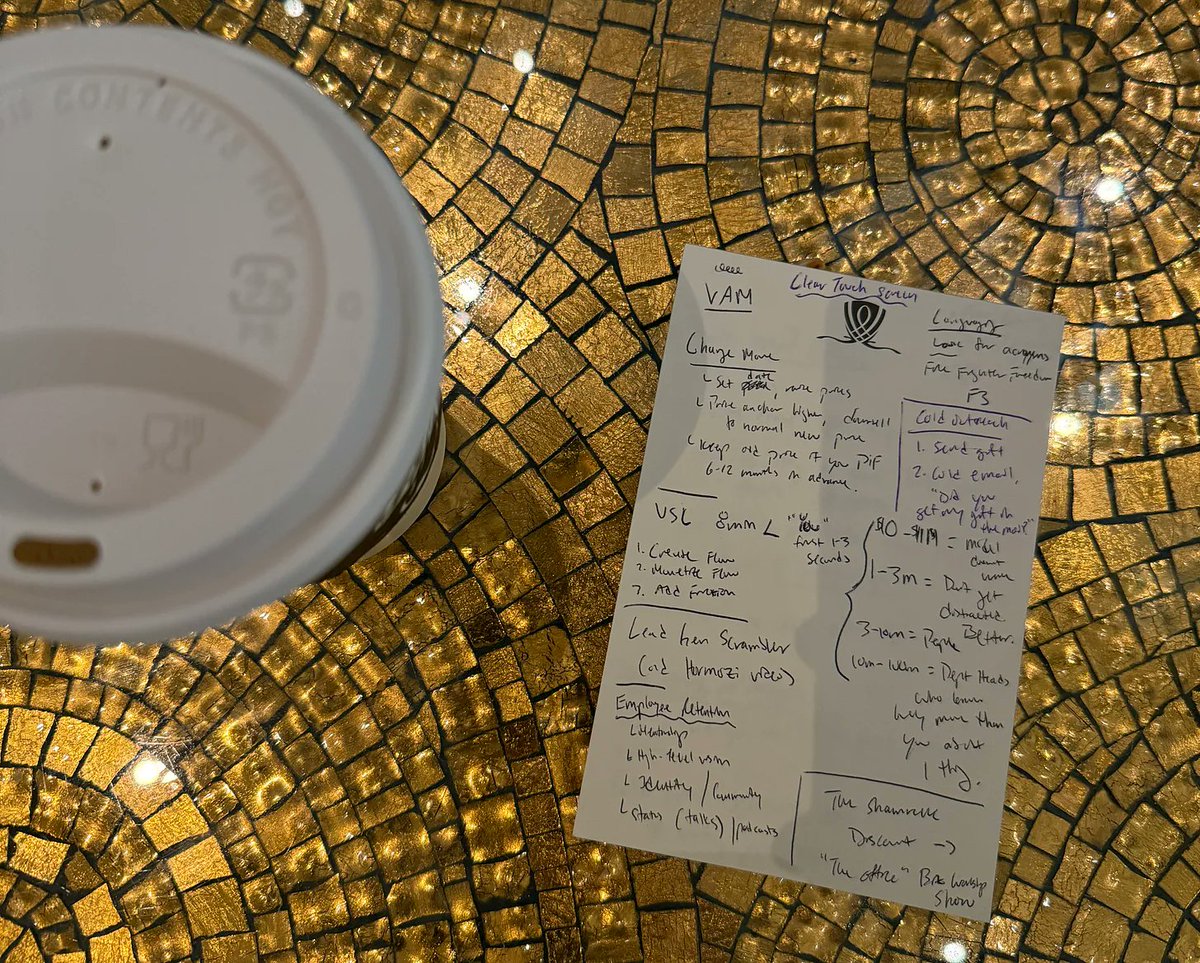

Okay, real talk: I found out about the 50/30/20 rule from some Reddit thread when I was doom-scrolling after getting hit with a surprise car repair bill. Fifty percent on needs, thirty on wants, twenty on savings or debt—sounds too clean, right? I figured it was for people who color-code their planners. But I was tired of choosing between groceries and Spotify Premium every month, so I gave this simple budgeting thing a shot in January 2025. https://www.forbes.com/advisor/banking/best-budgeting-apps/

DSC Multilingual Mystery #4: Isabelle and the Missing Spaghetti …

My first month was a disaster, obviously. I tried to be all precise, sat down with Google Sheets (which I abandoned after like three days because who has time), and realized my “needs” were already pushing 70% because rent here is criminal. But instead of quitting, I just… adjusted. That’s the part nobody talks about with the 50/30/20 rule—you can bend it a little without ruining everything.

Breaking Down My Actual 50/30/20 Rule Numbers Right Now streams of income

Here’s what my take-home pay looks like these days (after taxes, ugh):

- 50% Needs: Rent, utilities, groceries, minimum debt payments, car insurance, phone. Mine comes out closer to 55% most months because Austin rent is a joke, but I make it fit by buying H-E-B brand everything and pretending I like it.

- 30% Wants: Eating out, streaming services, random Target runs, concerts, thrift shopping. This is where I used to blow everything. Now I actually look forward to this chunk—it feels like permission to live instead of just survive.

- 20% Savings/Debt: Emergency fund, extra debt payments, Roth IRA contributions. I’ll be honest, some months this dips to 15% because life happens (looking at you, vet bill for my dog’s dramatic stomach issues last summer).

Nicolas Cole 🚢👻 on X

The Embarrassing Mistakes I Made With Simple Budgeting streams of income

Oh man, where do I start? First month, I put my gym membership in “needs” because “health,” then wondered why my wants category was starving. Spoiler: the gym was definitely a want. Another time I forgot to include holiday gifts until December hit and I panic-transferred from savings. Classic me. https://www.ynab.com/

And subscriptions—don’t get me started. I had like eight streaming services because “I might watch that show someday.” Canceling half of them freed up $60 a month that went straight to savings. Felt dumb, but also… freeing? The 50/30/20 rule forced me to actually look at where my money was going instead of pretending I was broke for mysterious reasons.

How the 50/30/20 Rule Is Working For Me in Late 2025 streams of income

I’ve got almost three months of expenses saved now, which is insane for me. Last week I booked a cheap flight to visit my sister for New Year’s without spiraling into credit card debt. That’s new. And yeah, I still splurge—had brisket tacos twice this week—but it’s in the 30% bucket, so it doesn’t wreck everything.

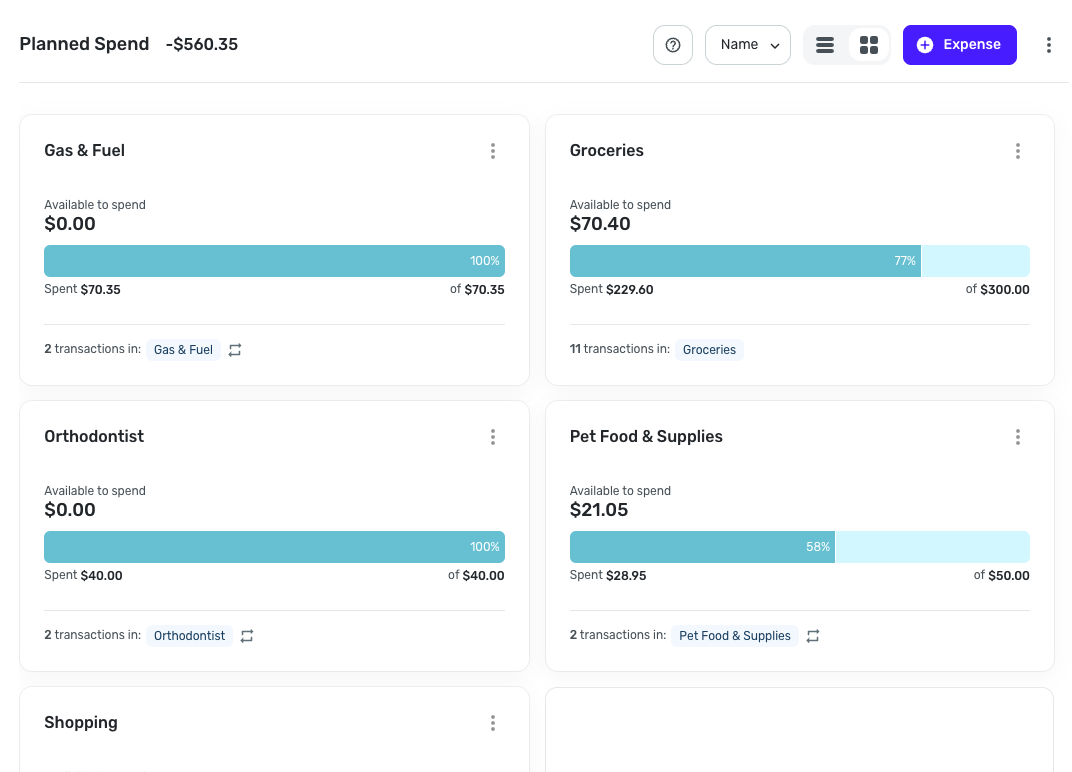

The best part? It’s simple enough that my chaotic brain can stick to it. No complicated apps (though I do use the free version of YNAB sometimes when I’m feeling fancy). Just rough math at the start of each month and occasional check-ins when I’m procrastinating on laundry. https://www.nerdwallet.com/finance/learn/nerdwallet-budget-calculator

Spending Plan Redesign: Share your feedback here! — Simplifi

My Not-Perfect Tips If You Wanna Try the 50/30/20 Rule streams of income

- Start messy. Don’t wait for the “perfect” month.

- Track spending for two weeks first—prepare to be horrified, it’s fine.

- Automate the 20% if you can. I send it to savings the day I get paid so I don’t see it.

- Be honest about what’s a need vs. want. Coffee out every day? Want. Internet? Need (sorry, remote work life).

- Forgive yourself when you mess up. I still do.

Anyway, that’s my rambling take on the 50/30/20 rule. It’s not magic, but for this disorganized American just trying to adult in an expensive world, it’s been weirdly life-changing. https://www.nerdwallet.com/finance/learn/nerdwallet-budget-calculator

If your finances feel like a dumpster fire right now, just try it for one month. Worst case, you learn exactly how much you spend on takeout (it’s me, I’m the worst case). Let me know how it goes—seriously, I love hearing other people’s money chaos stories. We’re all just figuring it out.